- Ledger Lowdown

- Posts

- A $40M Accounting Problem ADM Wanted Gone

A $40M Accounting Problem ADM Wanted Gone

just added the borders

The Wednesday Lowdown ⬇️

If you're new around here, every day or so I share the 4-5 best accounting insights I saw in the past 24 hours.

I scroll. so you don't have to.

🤯 WTF of the Day

ADM Just Paid $40M to Make an Accounting Mess Go Away

Archer Daniels Midland is a massive, 120-year-old agribusiness that buys crops and turns them into food ingredients, animal feed, and fuel. Think grain → everything.

What happened, ADM executives made the company’s nutrition unit look way more profitable than it really was by shifting profits from other parts of the business on paper. The SEC says this happened in 2021–2022 and misled investors.

TADM paid $40 million to settle, the stock dropped 24% when the scandal came out, and the CFO resigned. ADM didn’t admit wrongdoing, and prosecutors dropped criminal charges.

No jail, big fine, reputations wrecked.

🍿 What’s poppin in accounting

Don’t report the $1,776 “Warrior Dividend” on your taxes.

The Internal Revenue Service confirmed that the $1,776 payments sent to service members in December are not taxable. The money came from extra Basic Allowance for Housing (BAH) funds approved in the One Big Beautiful Bill, and BAH has always been tax-free.

Translation: this wasn’t “income.” It was a one-time housing supplement.

No federal tax. No reporting. No impact on retirement pay.

If you’re active duty (O-6 and below) or eligible reserve and saw this as a separate line on your LES, you’re good. File your return and move on.

Global HR shouldn't require five tools per country

Your company going global shouldn’t mean endless headaches. Deel’s free guide shows you how to unify payroll, onboarding, and compliance across every country you operate in. No more juggling separate systems for the US, Europe, and APAC. No more Slack messages filling gaps. Just one consolidated approach that scales.

📊 Weekly Trend Chart

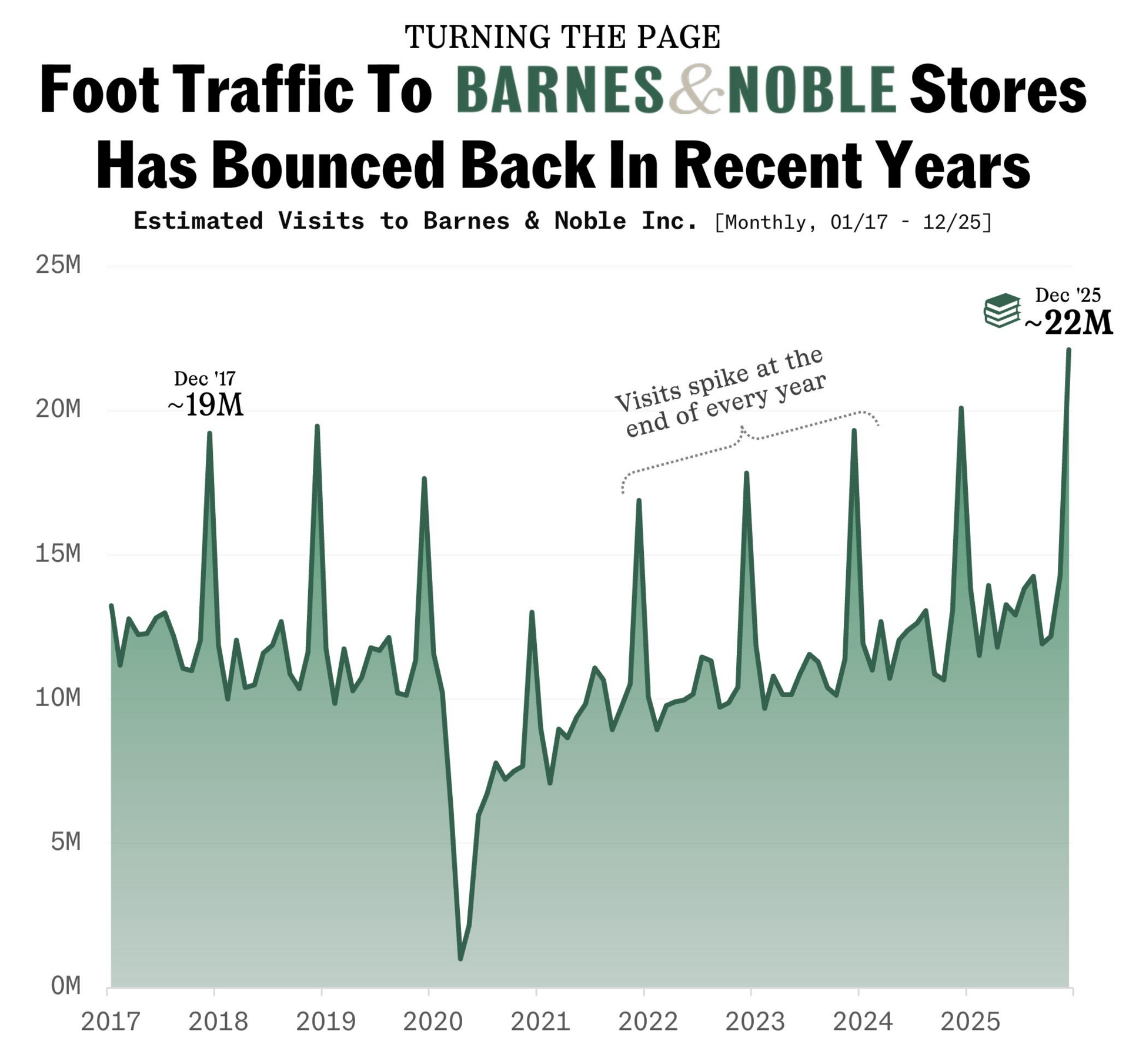

Barnes & Noble Is Back From the Dead (And Might IPO)

Everyone thought Barnes & Noble was finished. Amazon crushed it. E-books won. Stores felt dated. From 2014 to 2019, B&N lost over $1B in value and was bleeding money.

Then a hedge fund bought it in 2019 and did something shockingly simple: stopped trying to be Walmart. Fewer toys. More books. Gave local store managers real control. Leaned into indie vibes and BookTok hype. It worked. Store visits hit 22M last December, up 15% vs 2017.

Now they’re opening 60 new stores in 2026 and quietly exploring a multibillion-dollar IPO. The plot twist of the decade: the bookstore Amazon almost killed might end up as one of the hottest IPO stories next.

#😂 Meme of the Day

the disappointment i have in shows noadays 😂

What’d you think of today’s edition?

Hit reply and tell me.