- Ledger Lowdown

- Posts

- Accounting Firm Data Breach Exposed After 18-Month Delay

Accounting Firm Data Breach Exposed After 18-Month Delay

just added the borders

The Monday Lowdown ⬇️

If you're new around here, every day or so I share the 4-5 best accounting insights I saw in the past 24 hours.

I scroll. so you don't have to.

🤯 WTF of the Day

Firm Hid a Data Breach for 18 Months

Sax, a US accounting firm, was hacked in July 2024.

Hackers accessed personal data tied to about 230,000 people.

Clients didn’t hear about it until December 2025. That’s 18 months later.

Sax says they noticed the breach quickly, hired cybersecurity experts, and spent over a year figuring out what data was exposed. During that time, clients had no idea their information might be at risk.

Now Sax is offering 12 months of credit monitoring and identity protection. The least they could do!

Source: Cyber News

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

🍿 What’s poppin in accounting

The Big Four in 2025: Nobody’s Booming, Nobody’s Dying

Deloitte: Still the king. $70B+ in revenue. Growth bounced back to ~5%. They hired more people, restructured teams, and kept grinding. Big, steady, boring winner.

EY: Quietly solid. 4% growth overall. Consulting finally moved again. Hiring picked back up after last year’s cuts.

KPMG: Sneaky strong. 5% growth. Tax was the star. Also first Big Four firm to launch a US legal division. Playing offense in niche areas.

PwC: Slowest growth at 3%. Only Big Four firm cutting headcount. Still growing advisory, but clearly pulling back and tightening belts.

Source: business Insider

🕵️♂️ The Audit

Are you an outlier or the industry standard? Vote in our new weekly pulse check, and we’ll share the results next issue.

Last poll results:

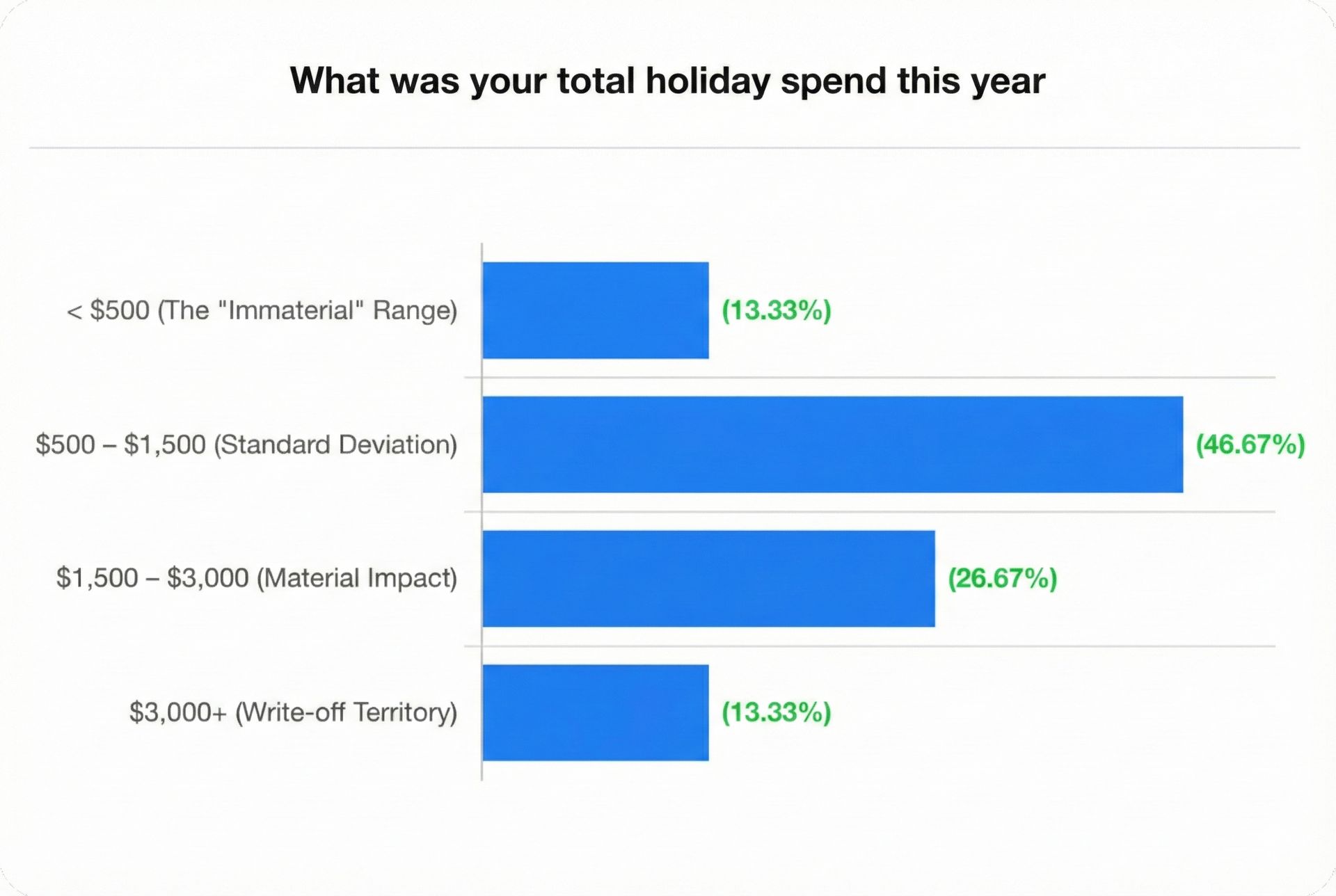

Almost half of you landed in the $500–$1,500 range. That’s the quiet middle where most holiday damage happens. A few of you went full write off mode. Respect.

New Poll ⬇️

What’s your biggest money regret from this year? |

🤝 Partner Spotlight

Payroll is annoying. Paying for it is worse.

SurePayroll is giving 9 months free to new users.

Set it up once, run payroll in minutes, and stop thinking about it.

This is one of those boring upgrades that actually saves time.

📊 Weekly Trend Chart

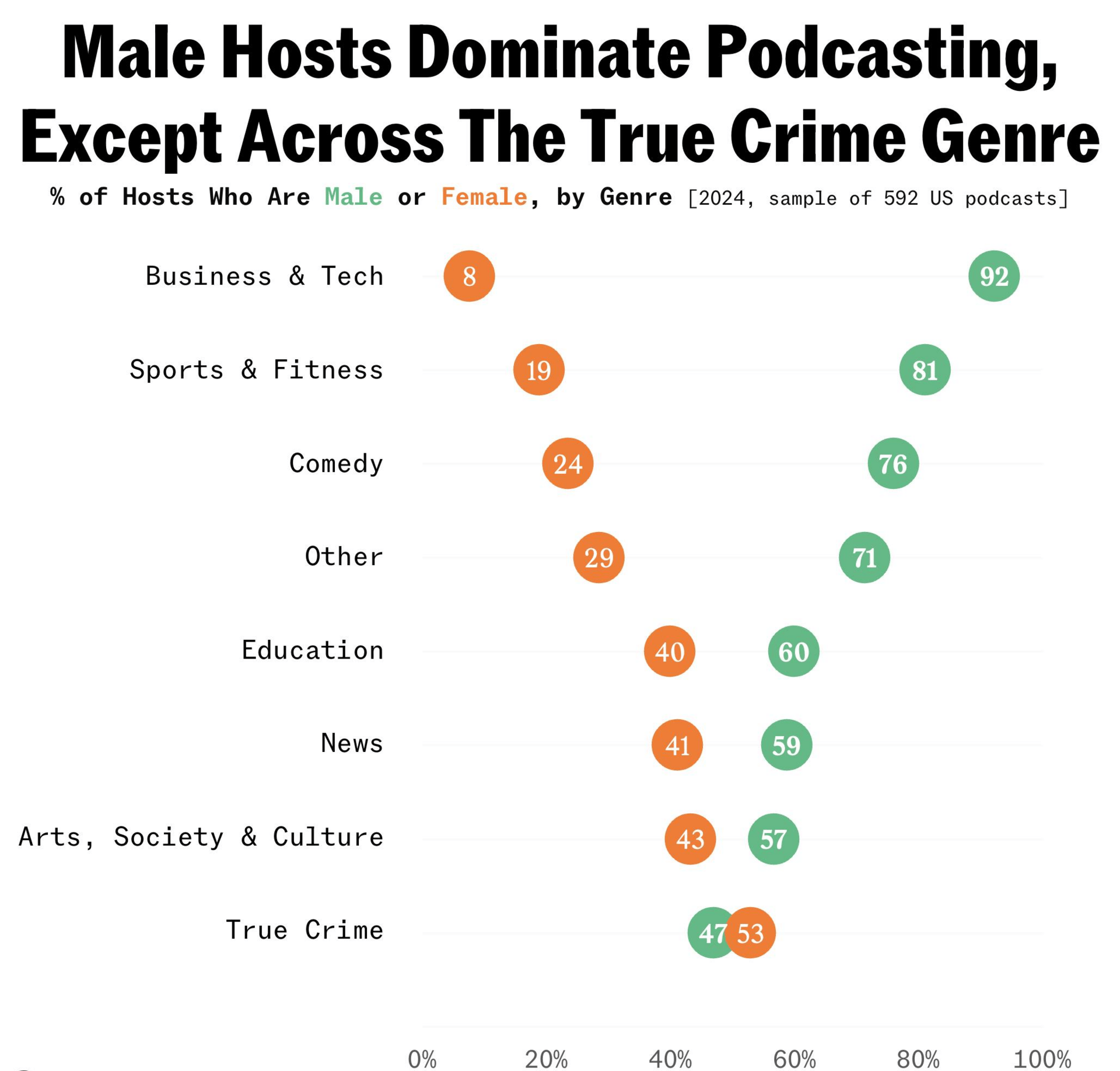

Podcasting Is Still a Guys’ Club

There was a joke years ago that a group of men should be called “a podcast.” Turns out the joke aged well.

A new study found women hosted just 33% of the top 592 US podcasts on Spotify last year. That’s worse than movies, TV, and music.

Only 8% have a female host. The one exception is true crime, where women actually outnumber men behind the mic.

At the very top it looks more balanced, but once you scroll past the biggest shows, it’s still mostly dudes talking into microphones.

#😂 Meme of the Day

😂 Love it

P.S. What'd you think of today's edition? Hit 'reply' to this email and lemme hear it!