- Ledger Lowdown

- Posts

- EY is facing its fifth investigation as auditors issue unauthorized reports. Not great.

EY is facing its fifth investigation as auditors issue unauthorized reports. Not great.

just added the borders

The Wednesday Lowdown ⬇️

If you're new around here, every day or so I share the 4-5 best accounting insights I saw in the past 24 hours.

I scroll. so you don't have to.

P.S. We made merch! It’s fun. It looks cool. Your accountant friends will want one. And it helps keep this newsletter free. Grab yours → CPA MERCH

🤯 WTF of the Day

EY Gets Hit With Yet Another Investigation

EY cannot catch a break. The UK accounting watchdog just launched a fifth investigation into the firm, this time because two EY auditors issued unauthorised audit reports. EY self-reported the issue, but it still triggered a full probe.

This stacks on top of investigations into EY’s work on the Post Office scandal, two unnamed companies, collapsed retailer Made.com, and NMC Health where EY is also facing a 2 billion dollar negligence claim. YIKES

EY has already paid more than 5 million pounds in fines this year. And with all these cases piling up, that bill could rise quickly. The firm says it cooperated, fixed the files, and no financial statements needed changes but regulators clearly are not letting up.

Source: FT.com

🍿 What’s poppin in accounting

Prosperity Partners Moves Into New York

Chicago’s Prosperity Partners just scooped up New York firm Farkouh, Furman & Faccio, giving them a real footprint in NYC plus a boost in audit and international tax talent. FFandF has been around since 1974 and works with a lot of high net worth families, so this is a solid credibility bump.

The combined firm is now roughly 75 million dollars in revenue with 242 employees and 10 offices. Financial terms weren’t shared.

Prosperity’s been on a buying spree Virginia, Vermont, Houston, Santa Barbara, Detroit, Maryland and now Manhattan. They’re becoming a national player one acquisition at a time.

Source: PE Hub

🕵️♂️ The Audit

Are you an outlier or the industry standard? Vote in our new weekly pulse check, and we’ll share the results next issue.

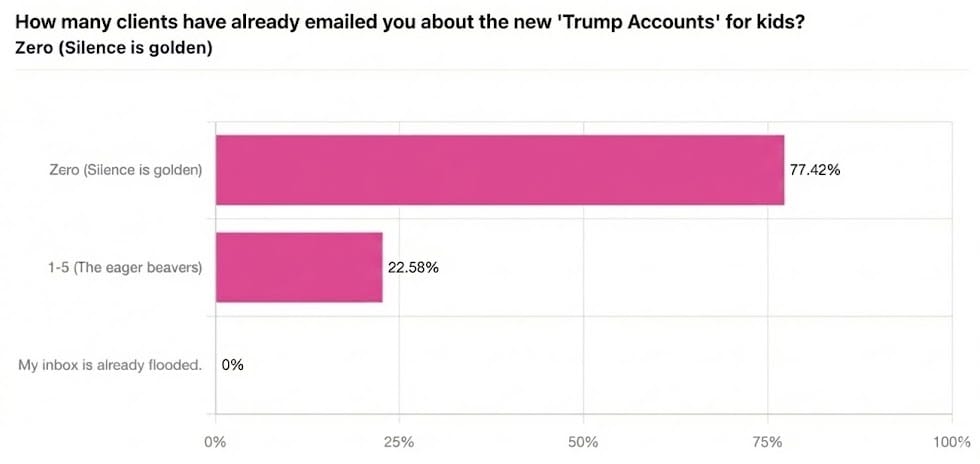

Last poll results:

Right now, 77% of you are in the "Silence is Golden" camp. That means your competitors are sleeping on this too.

Don’t wait for the inbox to flood. Be the 23%.

Send a simple email to your clients today saying: "Hey, you might hear about these 'Trump Accounts' soon. Here is the 3 bullet breakdown of what they are, and why we should (or shouldn't) care about them yet."

You look like a genius for predicting the question before they even asked it.

If you want reply to this email asking for a template and maybe the folks here at Ledger Lowdown can write up a draft for you!

New Poll ⬇️

When are you officially "signing off" for the holidays? |

📊 Weekly Trend Chart

Monster Pops, Celsius Drops

Monster had a killer quarter. Sales jumped 17 percent to 2.2 billion dollars, profits jumped 41 percent, and the stock shot up 5 percent. The CEO even said the quiet part out loud coffee is so expensive now that people are switching to energy drinks.

Celsius beat expectations too but still got hammered. The stock fell more than 20 percent because investors didn’t like that its newly bought brand Alani Nu is moving into Pepsi’s distribution network.

And through all this Red Bull is still the undisputed champ with almost 13 billion dollars in sales last year. Monster is half that. Celsius isn’t close.

#😂 Meme of the Day

😂

P.S. What'd you think of today's edition? Hit 'reply' to this email and lemme hear it!