- Ledger Lowdown

- Posts

- IRS Locks In 100% Bonus Depreciation and Clarifies the Fine Print

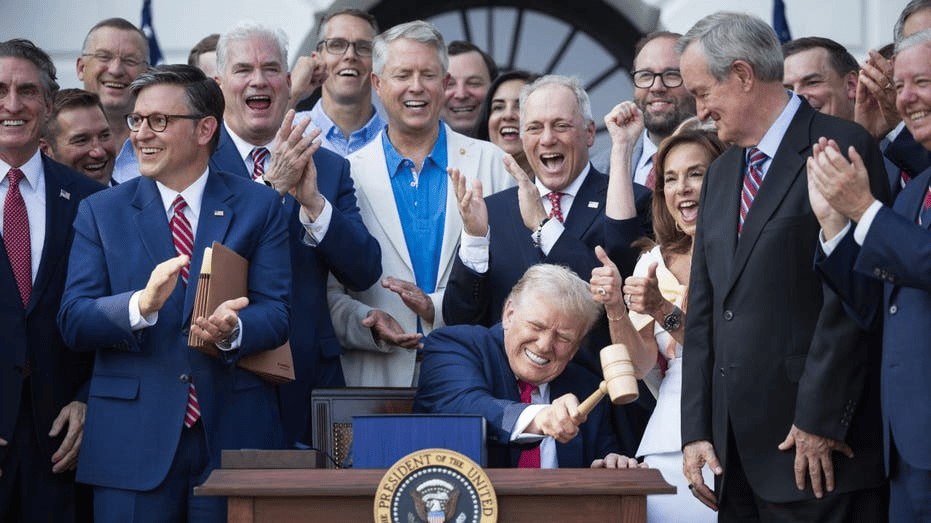

IRS Locks In 100% Bonus Depreciation and Clarifies the Fine Print

Bonus depreciation is officially back and not fading out this time.

OBBBA And 100% Bonus Depreciation

The One Big Beautiful Bill Act (OBBBA) permanently restored 100% first-year bonus depreciation for qualifying property acquired and placed in service after January 19, 2025. That means no scheduled phaseout and no sunset dates for eligible assets, shifting bonus from a temporary tactic to a standing feature of section 168(k).

For many businesses, this covers traditional short-lived equipment, certain plants, computer software, qualified improvement property, and other tangible property with a recovery period of 20 years or less. The IRS’s interim guidance in Notice 2026-11 lets taxpayers continue to rely on existing bonus depreciation regulations until new regulations are issued, which gives practitioners a familiar framework for 2026 planning.

Key Elections Under The New Rules

Taxpayers are not forced into 100% bonus in every case; several elections allow more nuanced income and credit management. These elections are central where state decoupling, NOL usage, or credit timing make an immediate full write-off suboptimal.

Election out of bonus for an entire class of property for a taxable year is still available, preserving the ability to stretch deductions under MACRS.

A new election allows 40% bonus instead of 100% for the first tax year ending after January 19, 2025, with a 60% rate available for certain long-production-period property and qualified aircraft.

Elections can apply bonus depreciation to specified plants, and certain components of self-constructed property can be treated as separately eligible rather than folded into a single unit of property.

Taxpayers may elect not to claim bonus at all on qualified sound recording productions if a full first-year write-off would disrupt income smoothing, credit optimization, or state conformity.

Sound Recording Productions: New Opportunity

OBBBA extended bonus depreciation into the creative sector by making qualified sound recording productions eligible property. The IRS guidance clarifies how timing and “placed in service” rules work for this new category.

A qualified sound recording production is treated as acquired when “principal recording” begins, rather than when a contract is signed.

The production is placed in service on initial release or broadcast, which is the trigger for claiming 100% bonus.

To qualify for the permanent 100% rate, principal recording must start in a taxable year ending after July 4, 2025, and the production must meet U.S.-based production requirements.

This gives labels, production companies, and related businesses a powerful acceleration tool, but only if they track recording start dates, release timing, and eligibility criteria with precision.

What CPAs Should Focus On In 2026

The headline is certainty: 100% bonus depreciation is now a permanent part of the code for qualifying property acquired and placed in service after January 19, 2025. The real planning work, though, lives in the elections and their interaction with entity structure, state rules, and long-term cash flow goals.

CPAs should pay close attention to:

State conformity and decoupling rules, especially where states still follow pre-OBBBA phaseouts or require separate adjustments.

Income smoothing and credit utilization, including the effect of front-loaded deductions on R&D credits, foreign tax credits, and limitation-based provisions.

Acquisition and placed-in-service dates, binding contract timing, and related-party limitations for used property, which can make or break eligibility.

Documentation around sound recording and other newly eligible property so that acquisition, production, and release dates are defensible on exam.

Clients will often assume “100% now” is automatically the best answer, but for 2026 and beyond, the optimal move is frequently a tailored mix of bonus, MACRS, and strategic elections.