- Ledger Lowdown

- Posts

- IRS Opens 2026 CAP Applications

IRS Opens 2026 CAP Applications

The Tuesday Lowdown ⬇️

If you're new around here, every day I share the 4-5 best accounting insights I saw in the past 24 hours.

I scroll. so you don't have to.

💎 WTF of the Day

IRS: No New Stimmy Checks

The IRS shut down viral claims about $1,390 stimulus checks, confirming no new payments are being sent. A pinned post on its official X account warns taxpayers to watch out for scams, noting the Recovery Rebate Credit expired this April.

Confusion may stem from senator Josh Hawley’s recent proposal for tariff funded rebates, but that bill hasn’t advanced.

Translation: if you’re waiting by the mailbox, you might as well be waiting for Santa Claus.

Source: IRS X

💎 What’s poppin in accounting

IRS Opens 2026 CAP Program

The IRS will accept applications for its Compliance Assurance Process (CAP) from Sept. 3–Oct. 31, 2025. CAP lets big corporations (assets $10M+) resolve tax issues in real time with the IRS before filing returns.

This year’s program includes new rules to handle impacts from the IRA and CHIPS Act (like the corporate AMT, stock buyback tax, and clean energy credits). Accepted companies will be notified in Feb. 2026.

📊 Weekly Trend Chart

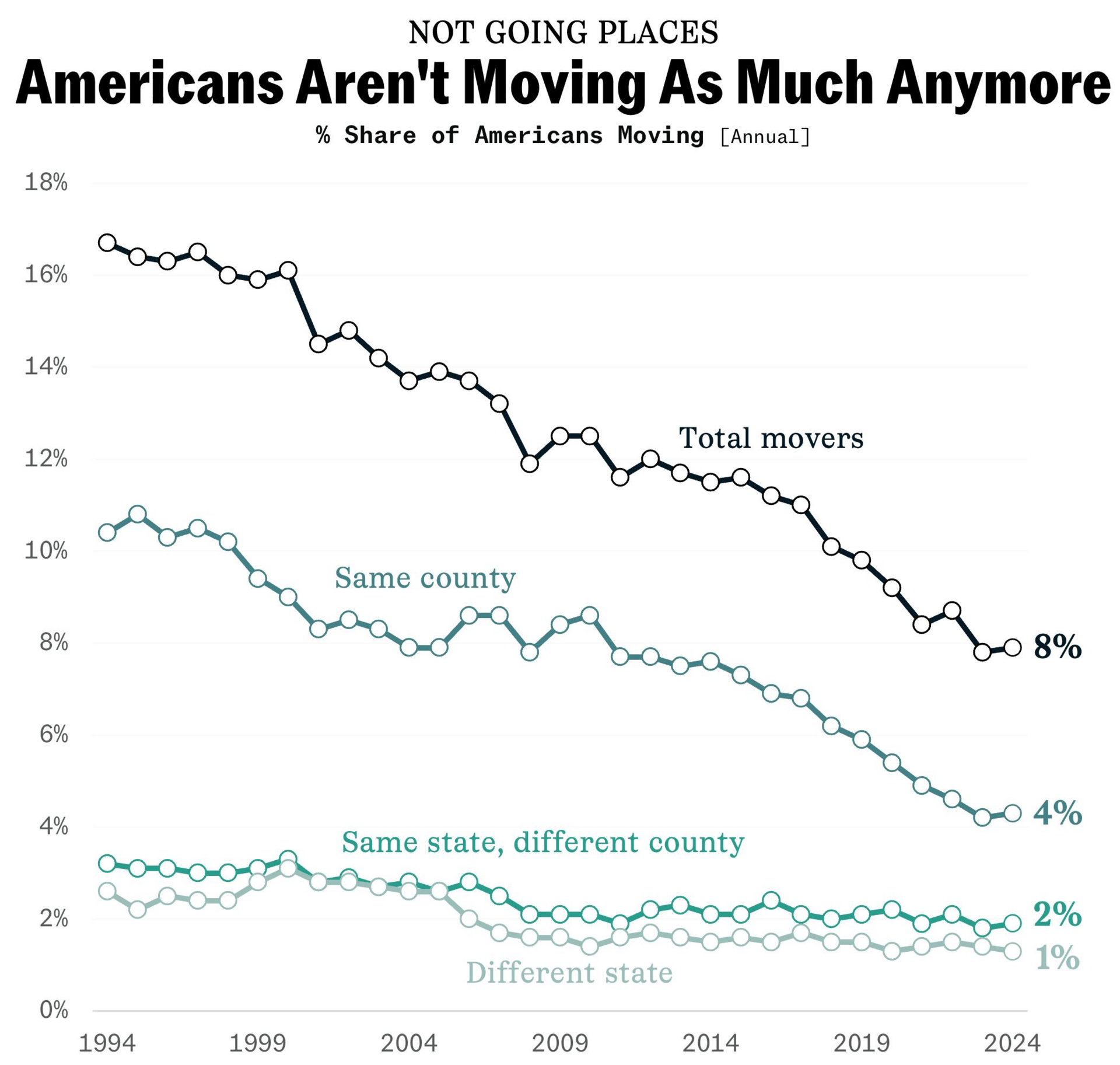

Americans Aren’t Moving Like They Used To

Back in the ’90s, 1 in 6 Americans packed up and moved each year. Now? It’s barely 1 in 12. People are “locked in” by low mortgage rates, juggling dual incomes, or just aging into stability.

Add in remote work (no need to move for the office) and sky high rents in hot cities, and it makes sense why folks are staying put.

#😂

Love this 😂

P.S. What'd you think of today's edition? Hit 'reply' to this email and lemme hear it!