- Ledger Lowdown

- Posts

- The Daily Lowdown - May 2 2025

The Daily Lowdown - May 2 2025

The Friday Lowdown ⬇️

If you're new around here, every day I share the 4-5 best accounting insights I saw in the past 24 hours.

I scroll. so you don't have to.

💎 WTF of the Day

Accounting firms are on a merger spree

Two more deals just dropped in the accounting world. CliftonLarsonAllen is merging in Dembo Jones, a 90-person firm in Maryland with 24 million dollars in annual revenue. The move deepens CLA’s presence in the DC metro area.

Meanwhile, Rehmann is combining with Martinet Recchia, a long-standing CPA firm in Northeast Ohio. It’s a strategic play to boost Rehmann’s footprint in the Great Lakes region. Both deals are more signs that mid-sized accounting firms are bulking up fast.

💎 What’s poppin in accounting

House republicans just voted to kill the PCAOB

We talked about this a couple days ago. Now it is real. House Republicans just voted 30 to 22 to eliminate the PCAOB, the audit watchdog set up after Enron, and move its duties to the SEC. The vote means the bill now heads to the full House as part of the broader budget package. If passed there, it moves on to the Senate.

PCAOB Chair Erica Williams says it would take years to rebuild the inspection teams and global agreements her agency runs. The bill also shifts PCAOB funding from public companies to the Treasury, and staff would likely face pay cuts as part of the move.

Source: Wall Street Journal

📊 Weekly Trend Chart

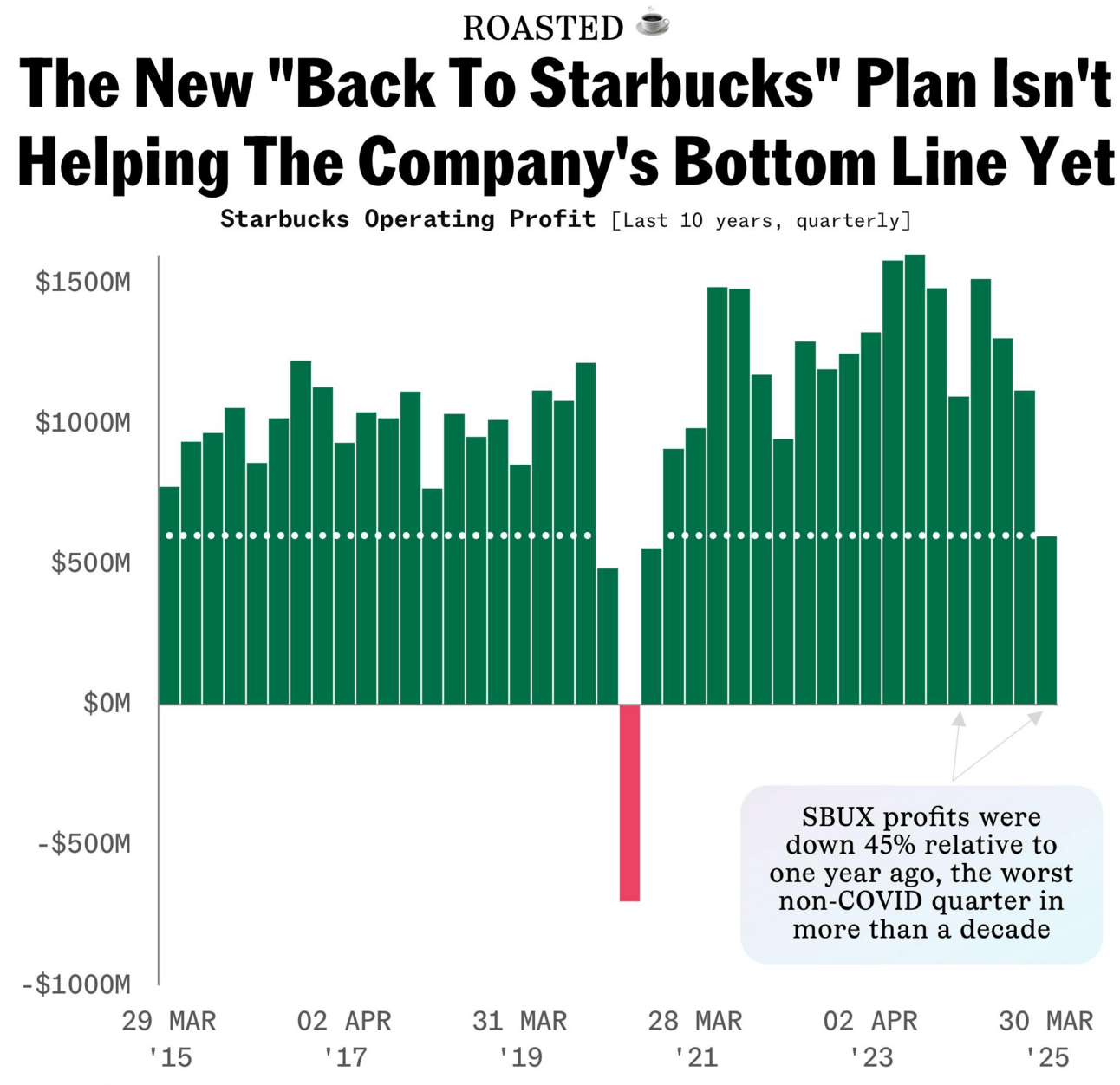

Starbucks turnaround is burning cash and losing steam

Starbucks just posted a brutal quarter. Profits are down 45 percent, same store sales have dropped five quarters in a row, and the stock tanked 10 percent. CEO Brian Niccol rolled out his big “Back to Starbucks” plan, more baristas, writing names on cups again, and making people buy something if they want to hang around.

But the extra labor is crushing margins. Coffee prices are up. China, once their golden market, is cooling off. What was supposed to be a comeback is starting to look like a slow, expensive slide.

#😂

😂 😂 take me backk!

P.S. What'd you think of today's edition? Hit 'reply' to this email and lemme hear it!