- Ledger Lowdown

- Posts

- The Partner Offer She Rejected

The Partner Offer She Rejected

just added the borders

The Wednesday Lowdown ⬇️

If you're new around here, every day or so I share the 4-5 best accounting insights I saw in the past 24 hours.

I scroll. so you don't have to.

Starting today we’ll do polls once a week on Fridays instead of every email. Keeps things lighter, more fun, and actually worth voting on.

🤯 WTF of the Day

EY Decided Not to Move From Its Global HQ in London

With its lease expiring in 2028, EY had a chance to move its global HQ. Instead, it renewed and will stay at its current London office until at least 2040.

They’ve been at 1 More London Place since 2003. About 8,000 people work there. It’s right on the Thames and next to a PwC office.

EY says the reason is simple: great location and easy transport. Translation: moving is expensive, disruptive, and London still works.

While Deloitte gears up for a shiny new HQ in New York, EY is choosing stability over flash.

🤝 Partner Spotlight

Someone just spent $236,000,000 on a painting. Here’s why it matters for your wallet.

The WSJ just reported the highest price ever paid for modern art at auction.

While equities, gold, bitcoin hover near highs, the art market is showing signs of early recovery after one of the longest downturns since the 1990s.

Here’s where it gets interesting→

Each investing environment is unique, but after the dot com crash, contemporary and post-war art grew ~24% a year for a decade, and after 2008, it grew ~11% annually for 12 years.*

Overall, the segment has outpaced the S&P by 15 percent with near-zero correlation from 1995 to 2025.

Now, Masterworks lets you invest in shares of artworks featuring legends like Banksy, Basquiat, and Picasso. Since 2019, investors have deployed $1.25 billion across 500+ artworks.

Masterworks has sold 25 works with net annualized returns like 14.6%, 17.6%, and 17.8%.

Shares can sell quickly, but my subscribers skip the waitlist:

*Per Masterworks data. Investing involves risk. Past performance not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

🍿 What’s poppin in accounting

She Got a Partner Offer From a Billion Dollar Firm. She Said No.

An accounting founder was offered a partner role at a billion-dollar firm. Big paycheck. Big name. Easy path.

She said no…. Why? Because the deal came with strings. Her firm would disappear. Her team would get absorbed. Decisions would slow down. Her autonomy would be gone.

Instead, she doubled down on her own business.

She listened to what clients had been asking for all along (tax services), hired the right experts, and expanded without killing her culture. No committees. No permission. No burnout machine.

The takeaway, selling isn’t always the smart move. Sometimes the fastest growth comes from doing more for the clients you already have, and keeping your name on the door.

Source: Inc

📊 Weekly Trend Chart

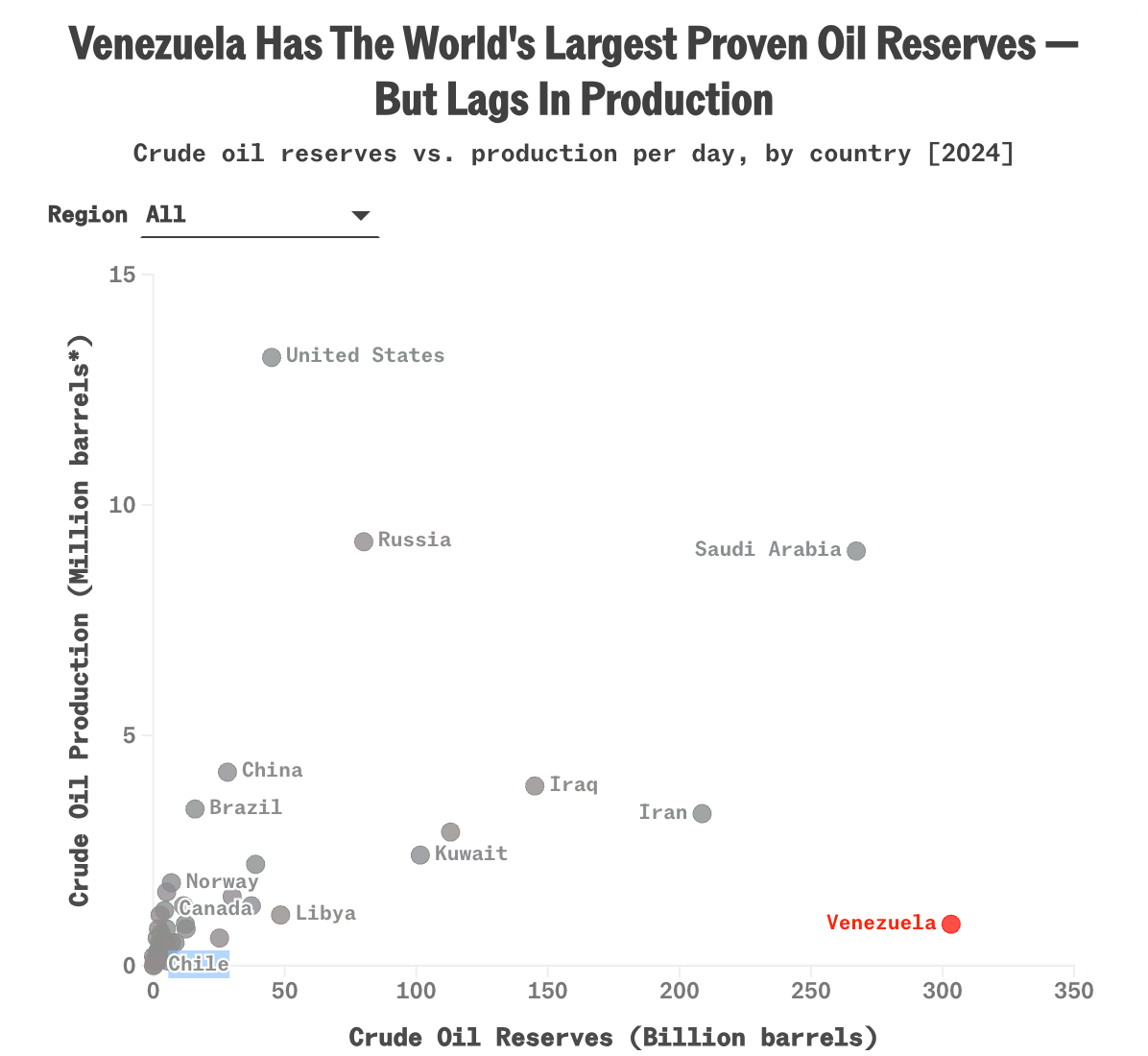

Wall Street Smells Money in Venezuela

Oil and defense stocks popped after the US captured Venezuela’s president over the weekend.

Trump said the US will temporarily run the country and that American oil companies are ready to spend billions fixing Venezuela’s broken oil industry. That’s a big deal since Venezuela has the world’s largest oil reserves.

Investors rushed into Chevron, Exxon, oil-service firms like Halliburton, and defense names like Lockheed and Palantir.

Oil prices barely moved. This wasn’t about oil going up. It was about who gets paid to rebuild.

#😂 Meme of the Day

😂 😂

P.S. What'd you think of today's edition? Hit 'reply' to this email and lemme hear it!