- Ledger Lowdown

- Posts

- Wisconsin Slaps StubHub With an $8.5M Tax Bill

Wisconsin Slaps StubHub With an $8.5M Tax Bill

just added the borders

The Wednesday Lowdown ⬇️

If you're new around here, every day or so I share the 4-5 best accounting insights I saw in the past 24 hours.

I scroll. so you don't have to.

🤯 WTF of the Day

Wisconsin Handed StubHub an $8.5M Tax Bill

Wisconsin just told StubHub to pay up.

A state appeals court ruled that StubHub owes $8.5 million in sales tax, saying the company counts as a seller, not just a middleman. The logic is simple, StubHub controls the transaction, processes the payment, and transfers the ticket. That’s a sale.

StubHub argued it only connects buyers and sellers and just collects fees. The court didn’t buy it.

Why this matters, this isn’t just about Wisconsin. It’s a warning shot for online marketplaces everywhere. If you touch the transaction too much, states may decide you’re the seller and hand you the tax bill.

Source: Bloomberg

🤝 Today’s Spotlight

Dalio: “Stocks Only Look Strong in Dollar Terms.” Here’s a Globally Priced Alternative for Diversification.

Ray Dalio recently reported that much of the S&P 500’s 2025 gains came not from real growth, but from the dollar quietly losing value. Reportedly down 10% last year!

He’s not alone. Several BlackRock, Fidelity, and Bloomberg analysts say to expect further dollar decline in 2026.

So, even when your U.S. assets look “up,” your purchasing power may actually be down.

Which is why many investors are adding globally priced, scarce assets to their portfolios—like art.

Art is traded on a global stage, making it largely resistant to currency swings.

Now, Masterworks is opening access to invest in artworks featuring legends like Banksy, Basquiat, and Picasso as a low-correlation asset class with attractive appreciation historically (1995-2025).*

Masterworks’ 26 sales have yielded annualized net returns like 14.6%, 17.6%, and 17.8%.

They handle the sourcing, storage, and sale. You just click to invest.

Special offer for my subscribers:

*Based on Masterworks data. Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

🍿 What’s poppin in accounting

New Jersey Just Joined the CPA Bandwagon

New Jersey just hopped on the same trend a bunch of other states are already on.

Gov. Phil Murphy signed a law that adds a new path to CPA licensure. The state approved a new CPA path that skips the 150-credit requirement. Now it’s bachelor’s degree + two years of experience + passing the CPA exam. Same license. Less school. Faster timeline.

This puts New Jersey in line with 20+ other states trying to fix the accountant shortage. Firms need people. Fewer hoops is the fastest way to get them.

📊 Weekly Trend Chart

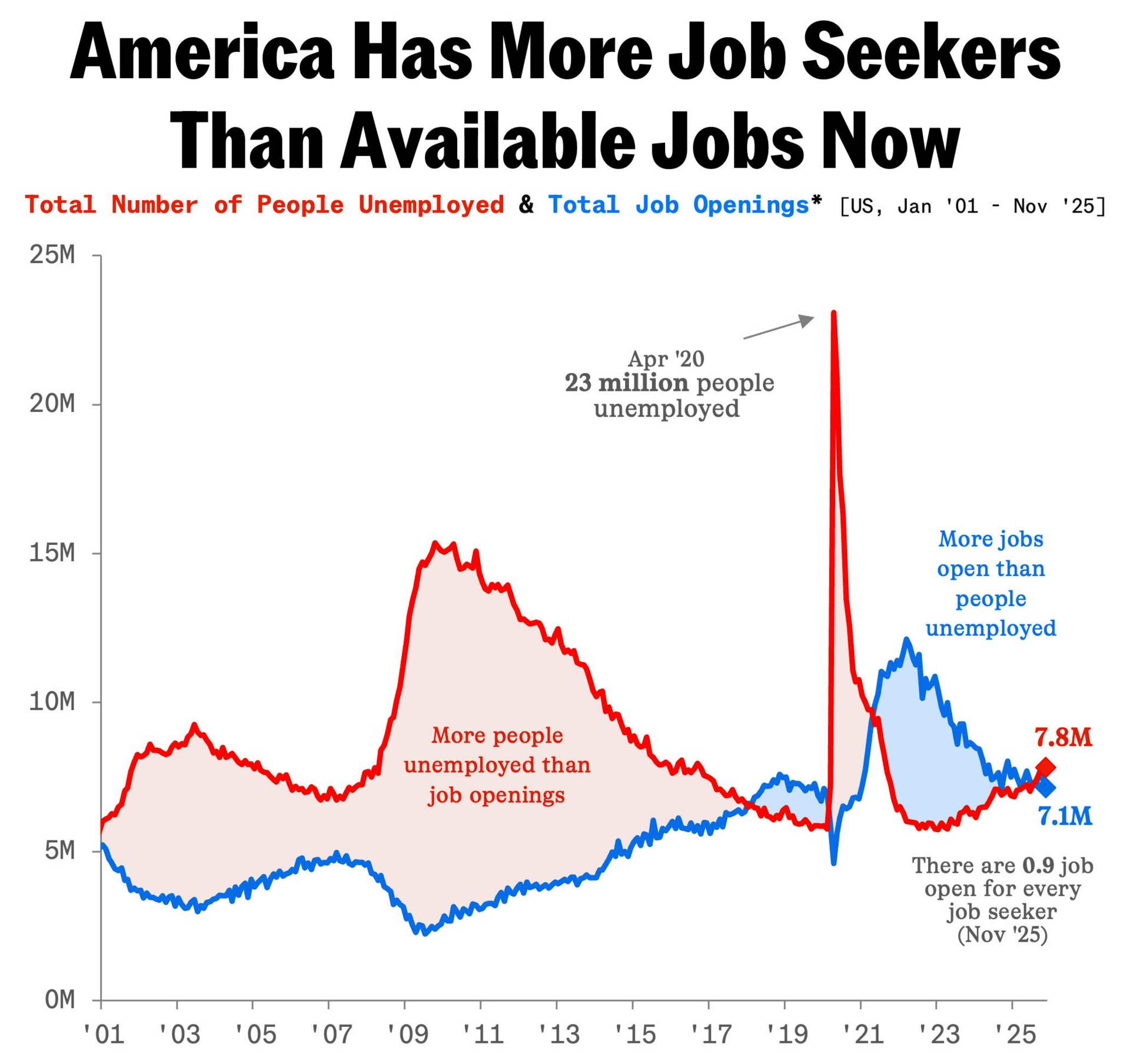

The Hiring Party Is Over

In November, the US had about 0.9 job openings for every unemployed worker. Translation: there are now more job seekers than available jobs. That hasn’t happened since before the pandemic.

Hiring is slowing. Layoffs are also slowing. Companies aren’t panicking, but they’re not expanding either. It’s a “hire less, fire less” economy.

A few years ago, workers had all the leverage. Two jobs for every person. Today, that leverage is gone. The job market didn’t crash. It just got… tight again.

#😂 Meme of the Day

😂

P.S. What'd you think of today's edition? Hit 'reply' to this email and lemme hear it!