- Ledger Lowdown

- Posts

- IRS 2026 Tax Season Update: Trump Savings Accounts Revealed!

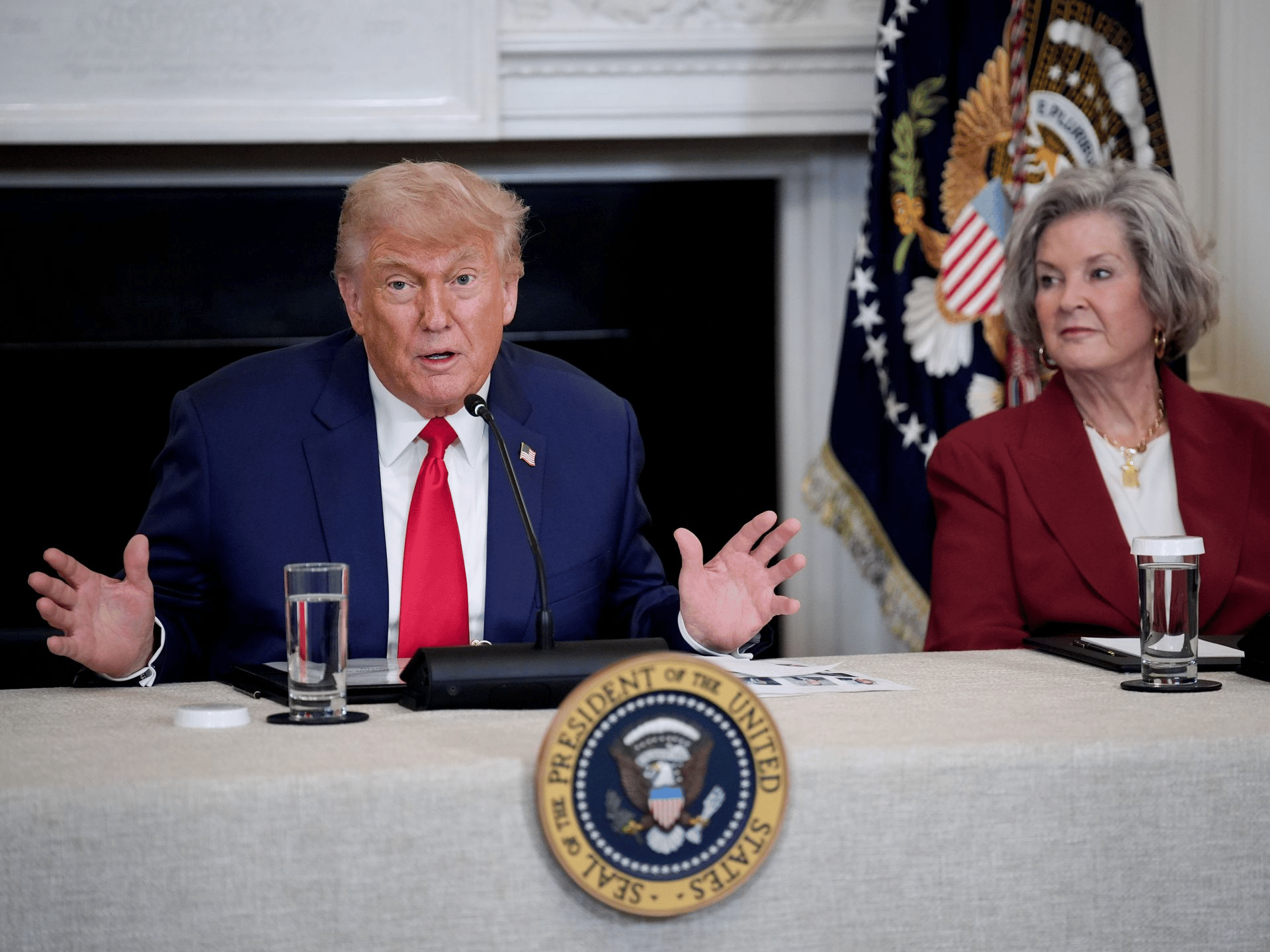

IRS 2026 Tax Season Update: Trump Savings Accounts Revealed!

just added the borders

The Friday Lowdown ⬇️

If you're new around here, every day or so I share the 4-5 best accounting insights I saw in the past 24 hours.

I scroll. so you don't have to.

🤯 WTF of the Day

How Trump Savings Accounts Work in the New OBBBA

The new tax law created something called a Trump Savings Account.

It’s basically a baby IRA.

Kids born from 2025–2028 get a $1,000 head start from the government. Anyone can add money. Parents. Grandparents. Even employers. You can put in up to $5,000 a year until the kid turns 18.

The money grows tax-deferred. You can’t touch it until 18. At that point, it turns into an IRA. No requirement to use it for college.

This is less about education and more about getting families to invest early. Compounding does the real work.

Source

🍿 What’s poppin in accounting

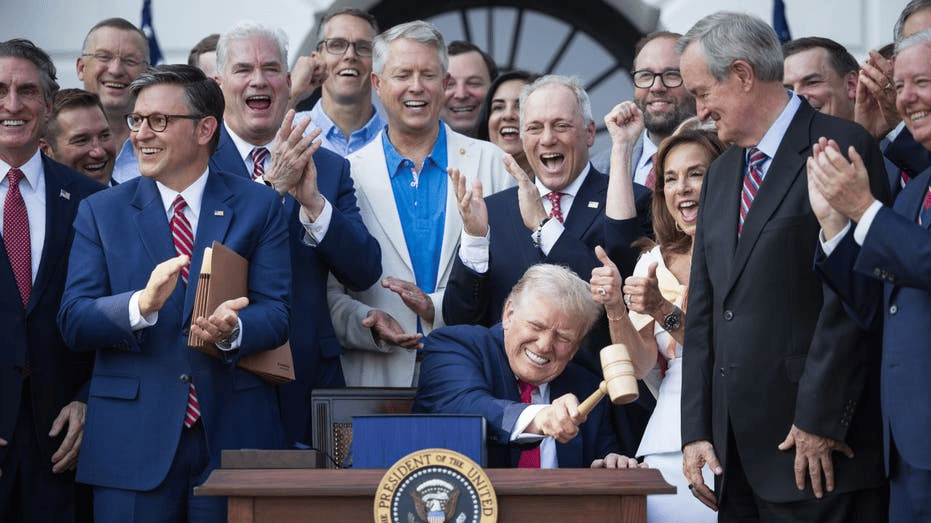

The IRS Just Made 100% Bonus Depreciation Permanent

This is a sneaky big deal.

The IRS dropped new guidance saying 100% first-year depreciation is now permanent. No phase-downs. No “sunsets.” If you buy qualifying business property after Jan 19, 2025, you can expense the whole thing immediately.

This came out of the One Big Beautiful Bill Act. The IRS basically said: yes, it’s real, yes, you can rely on it.

A few wrinkles:

It applies to most normal depreciable business assetsSound recording productions now qualify, so albums and similar projects can be written off fast

You can still elect 40% or 60% depreciation instead of 100% if you want more control

🤝 Masterworks

Investors see ANOTHER return on Masterworks (!!!)

That’s 3 sales this quarter. 26 sales total.

And the performance?

14.6%, 17.6%, and 17.8% → The three most representative annualized net returns.

(See all 26 at Masterworks.com)

Masterworks is the biggest platform for investing in an asset class that hasn’t moved in lockstep with the S&P 500 since ‘95.

In fact, the market segment they target outpaced the S&P overall in that time frame.*

Not private equity or real estate… It’s contemporary and post war art. Crazy, right?

Masterworks investors are typically high net worth, but the point is that you don’t need to be a capital-B BILLIONAIRE to invest in high-caliber art anymore.

Banksy. Basquiat. Picasso and more.

80+ of the world’s most attractive artists have been featured.

511+ artworks offered

$67.5mm paid out as of December 2025

$2.3mm+ average offering size

Looking to update your investment portfolio before 2026?

*Masterworks data. Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

🕵️♂️ The Audit

Are you an outlier or the industry standard? Vote in our new weekly pulse check, and we’ll share the results next issue.

Last poll results:

This isn’t a student newsletter. It’s battle-tested CPAs who’ve seen every cycle, every busy season! Respect. Also… no wonder you’re tired 😅

New Poll ⬇️

What do you want more of in this newsletter? |

📊 Weekly Trend Chart

America Is Quietly Turning Into a Country of People Living Alone

This stat is kind of wild and nobody is talking about it.

Almost 40 million Americans now live alone. That’s 29% of all households. Highest ever. And we added 1.3 million solo households in just one year.

This isn’t some fringe lifestyle anymore. It’s normal. People are getting married later (or not at all), making more money, and older Americans are living longer on their own. Same thing is happening across most rich countries.

Less “nuclear family.” More “me, my dog, and a streaming subscription.”

#😂 Meme of the Day

To be completely honest, I NEVER get it right the first time 😂 😂

P.S. What'd you think of today's edition?

Hit 'reply' to this email and lemme hear it!